Accounting updates

Updates from NFRA

Section 132(2)(b)1 of the Companies Act, 2013, read with Rule 4(2)(c)2 of the National Financial Reporting Authority Rules, 2018 (NFRA Rules, 2018) mandates the National Financial Reporting Authority (NFRA) to monitor and enforce compliance with the Accounting Standards (AS) and Standards on Auditing (SA).

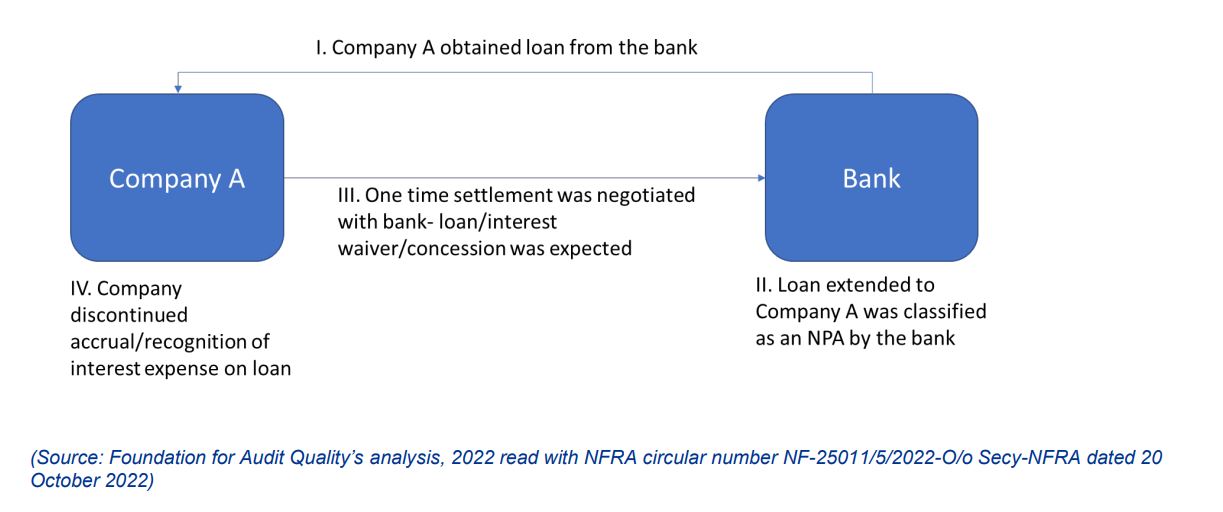

In this regard, NFRA, vide a circular dated 20 October 2022 issued guidance with respect to the accounting treatment of interest on borrowings undertaken by companies. This was based on NFRA’s observations during the course of its proceedings initiated against an auditor of a listed company (say Company A). The facts of the case are given below:

The NFRA observed that a bank had extended a loan to Company A, however, it subsequently classified the loan as an NPA. Company A was negotiating a one-time settlement with the bank, wherein it expected loan/interest waiver/concession from the bank, however, as at the balance sheet date a one-time settlement was not finalised. Based on its expectation of an interest waiver, Company A discontinued the accrual and recognition of interest expense on its bank borrowings. The NFRA determined that the accounting treatment followed by the company was in contravention of the provisions of the Indian Accounting Standards (Ind AS).

The NFRA in its analysis stated that Ind AS 109, Financial Instruments mandates classification and measurement of financial liabilities at amortised cost3, till the time such financial liabilities get extinguished4. A financial liability is considered to have been extinguished only when the borrower has been legally released from the primary responsibility for the liability, or part of it, either due to process of law, or by the creditor. In the present case, even though the bank had classified the loan as an NPA and had discontinued recognising interest income thereon5, it had not legally released Company A from its contractual obligations. Accordingly, as per the principles of Ind AS 109, Company A should continue to measure and present the amortised cost of the financial liability and the related interest expense in the balance sheet and statement of profit and loss respectively

To access the text of the NFRA circular, please click here

- Section 132 of the Companies Act, 2013 specifies provisions with respect to constitution of NFRA.

- Rule 4 of the NFRA Rules, 2018 lays down provisions regarding the functions and duties of NFRA.

- Ind AS 109 prescribes specific exemptions to this requirement.

- For computing the amortised cost of a financial liability, an entity needs to adopt the Effective Interest Method (EIM).

- As per the Reserve Bank of India (RBI) prudential norms on income recognition, asset classification and provisioning pertaining to advances, on an account becoming an NPA, the banks must discontinue the recognition of the related interest income and accordingly reverse the interest amount already charged but not collected. However, banks must continue to maintain a memorandum record of accrued interest on such NPAs, thereby not legally releasing the borrowers from their contractual obligations.

Action Points for Auditors

-

NFRA is scrutinising financial statements prepared by

companies and the audit performed by the auditors.

Consequently, NFRA has issued various Financial Reporting

Quality Review Reports (FRQRR) and Audit Quality Review

Reports (AQRRs). Some of the key recommendations of the

FRQRR and AQRs include:

- Independence of auditors is critical to achieve audit quality

- Audit professionals should exercise enhanced professional skepticism during the course of an audit

- Materiality is an important aspect in an audit and auditors should ensure that they consider all facts and circumstances of a company and select appropriate benchmark and percentage while computing materiality

- Companies should ensure completeness and robustness of accounting policies

- Going concern assessments should be appropriately performed by management and reviewed by auditors

- Auditors should make sure that they have timely and regular communication with Those Charged With Governance (TCWG)

- Auditors should ensure robust documentation in an audit

- Focus on certain aspects of accounting of financial instruments, revenue recognition, and other key matters

Our Insights

Tools and Enablers

- Standard workpapers

- Technology tools

Resources

- Regulatory updates

-

India updates

Accounting updates

Auditing updates

Regulatory updates

-

International updates

Accounting updates

Auditing updates

Regulatory updates

-

Recap on key updates

-

Publications

India Publications

International Publications

-

Matter for auditors’ attention

-

Discussion/Consultation papers and Publications issued by regulators

India Publication

International Publication

Exposure Drafts/consultation papers

EDs/consultation papers

Matters for Consultation