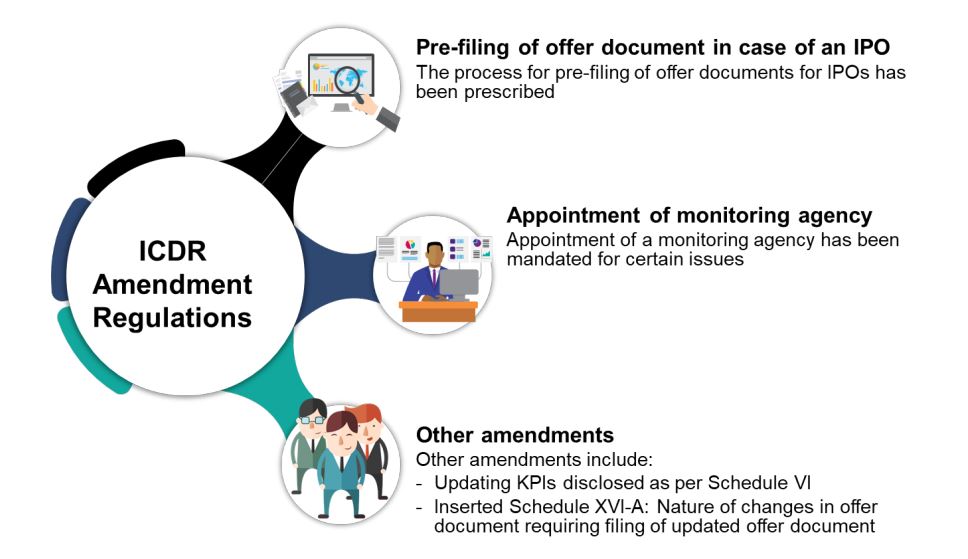

Recently, SEBI, vide a notification dated 21 November 2022 issued amendments to the SEBI (Issue of Capital and Disclosure

Requirements) Regulations, 2018 (ICDR Regulations)26. Some of the key amendments issued include:

(Source: Foundation for Audit Quality’s analysis, 2022 read with ICDR Amendment Regulations)

Pre-filing of draft offer document

In May 2022, SEBI had issued a consultation paper27 proposing that issuers of securities be permitted to pre-file offer documents when

contemplating an Initial Public Offer (IPO).

The ICDR Amendment Regulations have incorporated the proposals by inserting a new chapter, ‘Chapter IIA, Initial Public Offer on Main

Board through pre-filing of draft offer document’ in the ICDR Regulations. Chapter IIA gives details of the steps to be followed while prefiling an offer document. The key guidelines prescribed by the ICDR Amendment Regulations are given below:

Step 1: Pre-filing of draft offer document with SEBI and the stock exchanges

Prior to an IPO, following documents will be filed with SEBI and the stock exchanges:

|

The Lead Manager (LM) associated with an issue will file the following documents with

SEBI:

-

Three copies of Draft Offer Document (DOD) in accordance with Schedule IV

along with fees in Schedule III

- A certificate confirming an agreement between the issuer and the LM

- A due diligence certificate issued by the LM in a prescribed form

-

In case of an issue of convertible debt instruments, a due diligence certificate

from the debenture trustee in a prescribed form

-

An undertaking, in a prescribed format, from the issuer and LM that they will not

advertise or market the issue

|

The issuer will file the following

documents with the stock

exchange where the securities are

proposed to be listed (stock

exchange):

- Pre-filed DOD

- Prescribed details of the promoter

|

Public notice

Within two days of pre-filing the DOD with SEBI, the issuer will make a public announcement* regarding the fact that the DOD has

been pre-filed (no other detail will be provided in the public announcement).

Issuer should also clarify that pre-filing of DOD does not necessarily mean that an IPO will be undertaken.

* All public announcements will be undertaken in one English newspaper, one Hindi newspaper and one regional language newspaper at the place

where the registered office of the issuer is situated. All three newspapers should have a wide circulation.

It is to be noted that pre-filed DOD will not be made available to the public.

Step 2: Changes and observations by SEBI

SEBI will recommend changes or issue observations on the pre-filed DOD within a prescribed time period.

Step 3: Updated Draft Red Herring Prospectus I (UDRHP I)

A. Submission of UDRHP I to SEBI

Changes suggested by SEBI will be processed by the issuer and LM on the pre-filed DOD, and a UDRHP I will be submitted to

SEBI28 along with:

-

a statement certifying that all changes, suggestions and observations made by SEBI have been incorporated in the offer

document

- a due diligence certificate issued by the LM in a prescribed format at the time of filing of the offer document.

B. Making UDRHP I public

The UDRHP I will be made public for comments for a period of at least 21 days from the date of filing. It will be hosted on the

websites of SEBI, the stock exchange(s) and of the LM.

Public notice

Within two days of filing the UDRHP I, with SEBI, an issuer will make a public announcement regarding the fact that UDRHP I has

been filed, and inviting the public to provide their comments to SEBI, the issuer and to the LM in respect of the disclosures provided

in the UDRHP I.

Step 4: UDRHP II

After expiry of the public comment period, the issuer and the LM will submit the following documents to SEBI:

- Comments received by them from the public on the UDRHP I and consequential changes required to be processed to the same

- UDRHP-II – (i.e., document issued after changes have been processed upon UDRHP I).

Step 5: Filing offer document

A. Before filing offer document

Before filing the offer document with the Registrar of

Companies (ROC), the LM will submit the following

documents to SEBI:

-

a statement certifying that all changes, suggestions

and observations made by SEBI have been

incorporated in the offer document;

-

a due diligence certificate issued by the LM, in

prescribed format, at the time of filing of the offer

document;

-

a copy of the resolution passed by the Board of

Directors of the issuer for allotting specified securities

to promoter(s) towards amount received against

promoters’ contribution, before opening of the issue;

-

a certificate from a statutory auditor, before opening of

the issue, certifying that promoters’ contribution has

been received in accordance with the ICDR

Regulations, along with stipulated details of the

promoters and amounts received from them;

-

a due diligence certificate issued by the LM, in a

prescribed format, in the event the issuer has made a

disclosure of any material development by issuing a

public notice pursuant to para 4 of Schedule IX of the

ICDR Regulations29.

B. Filing offer document

The offer document will be filed with ROC, and post that

with SEBI and the stock exchanges. It will also be hosted

on the websites.

The subsequent procedures with respect to price band

advertisement/issue opening would remain same as prescribed

in Chapter II.

Interaction with the Qualified Institutional Buyers (QIBs): The ICDR Amendment Regulations specify that the interaction

with QIBs would be permitted, provided such interaction is only

limited to the extent of the information contained in the pre-filed

draft offer document. Further, it has been provided that the issuer

must prepare a list of the QIBs who have participated in such

interaction and obtain a confirmation of interaction from the QIBs,

to be submitted to SEBI.

Appointment of monitoring agency

Requirement of monitoring agency:

Chapters V and VI of the

ICDR Regulations lay down the principles governing preferential

issue and Qualified Institutions Placement (QIP) respectively.

The ICDR Amendment Regulations have introduced the

requirement to have the use of the proceeds of the preferential

issues and QIPs monitored by a credit rating agency registered

with SEBI (acting as a monitoring agency) in certain cases.

Following principles have been specified in this regard:

-

Applicability: Where the issue size of the preferential issue

or QIP exceeds INR100 crore30, the issuer must appoint a

monitoring agency to monitor the use of proceeds of the

issue. However, this requirement would not apply to an

issue of specified securities made by a bank or public

financial institution or an insurance company.

-

Submission of report by the monitoring agency: The

monitoring agency would submit its report to the issuer in

the specified format, on a quarterly basis, till 100 per cent

of the proceeds of the issue have been utilised. Post this,

the Board of Directors and management of the issuer must

provide their comments on the findings of the monitoring

agency.

-

Submission of report to the stock exchange(s) and

upload on website:

The issuer should, within 45 days

from the end of each quarter, upload the report of the

monitoring agency on its website and also submit it to the

stock exchange(s) on which its equity shares are listed.

-

Preferential issue of shares of companies having

stressed assets:

The ICDR Amendment Regulations have

specified that in case of preferential issue of shares of

companies having stressed assets, the issuer should make

arrangements for monitoring the use of proceeds of the

issue by a credit rating agency registered with SEBI

(earlier

public financial institution or by a scheduled commercial

bank, which is not a related party to the issuer)

. Also, the

monitoring agency should submit its report to the issuer on

a quarterly basis till 100 per cent

(earlier until at least 95

per cent)

of the proceeds of the issue have been utilised.

Other amendments

Other amendments introduced by the ICDR Regulations include:

-

Amendments to Schedule VI of the ICDR Regulations:

Part A of Schedule VI of the ICDR Regulations (Schedule

VI-A) deals with disclosures required in the offer document/letter

of offer. The ICDR Amendment Regulations have

introduced certain additional requirements in Schedule VI-A

of the ICDR Regulations, with regard to the Key

Performance Indicators (KPIs) disclosed by the issuer in the

offer document. These include:

-

Approval by an audit committee: KPIs disclosed in the

offer document must be approved by the audit

committee of the issuer company

-

Certification: KPIs disclosed in the offer document

should be certified by the statutory auditor(s), Chartered

Accountants, or firm of Chartered Accountants, holding a

valid certificate issued by the Peer Review Board of the

ICAI or by Cost Accountants, holding a valid certificate

issued by the Peer Review Board of the Institute of Cost

Accountants of India. The certificate issued in this regard

must be included in the list of material documents for

inspection.

-

Explanation of KPIs: KPIs disclosed in the offer

document should be comprehensive along with an

explanation stating how they have been used by the

management historically to analyse, track or monitor the

operational and/or financial performance of the issuer

company. Further, the issuer company should also

explain the comparison of KPIs over time, based on

additions or dispositions to the business, if any.

-

Disclosures under ‘Basis for Issue Price’ section:

The issuer company is required to make certain

disclosures under ‘Basis for Issue Price’ section. Some

of the key disclosures required to be made are as

follows:

-

Disclosure of all the KPIs that have been disclosed

by the issuer to its investors at any point of time

during the three years preceding the date of filing of

the DRHP or Red Herring Prospectus (RHP),

-

Confirmation by the audit committee stating that the

verified and audited details for all the KPIs that have

been disclosed to the earlier investors at any point of

time during the three years, prior to the date of filing

of the DRHP/RHP are disclosed under ‘Basis for

Issue Price’ section of the offer document,

-

Comparison of the KPIs disclosed with Indian listed

peer companies and/or global listed peer companies,

as the case may be.

Effective date31: The amendments are effective from the date

of publication in the Official Gazette, i.e., 21 November 2022.

To access the text of the ICDR Amendment Regulations, please click here

-

The amendments have been issued by the SEBI (Issue of Capital and

Disclosure Requirements) (Fourth Amendment) Regulations, 2022 (ICDR

Amendment Regulations).

- https://www.sebi.gov.in/reports-and-statistics/reports/may-2022/consultation-paper-on-pre-filing-of-offer-document-in-case-of-initial-public-offerings_58875.html

-

There has to be a minimum prescribed time gap between the date of

intimation to SEBI about the completion of interaction with the qualified

institutional buyers and the date of filing the UDRHP I.

-

Schedule IX of the ICDR Regulations deals with public communications and

publicity materials.

-

In case of a QIP issue, the threshold of INR100 crore would exclude the size of

offer for sale by selling shareholders.

-

The amendments to Schedule VI of the ICDR Regulations would be

applicable for all issues where RHP is filed with the Registrars of

Companies on or after the date of publication of these amendments in the

Official Gazette i.e., 21 November 2022.

Action Points for Auditors

As per the ICDR Amendment Regulations, the lead

manager(s) is required to submit various documents to

SEBI before filing the offer document with the Registrar of

Companies. One such document that needs to be submitted

is the certificate from the statutory auditor(s), certifying that

the promoters’ contribution has been received in

accordance with the ICDR Regulations. It should be

accompanied therewith the names and addresses of the

promoters who have contributed to the promoters‘

contribution and the amount paid and credited to the

issuer‘s bank account by each of them towards such

contribution.

Further, it has been mentioned that the KPIs disclosed in

the offer document must be approved by the Audit

Committee of the issuer company and duly certified by the

statutory auditor(s) or Chartered Accountants or firm of

Chartered Accountants, holding a valid certificate issued by

the Peer Review Board of the ICAI or by Cost Accountants,

holding a valid certificate issued by the Peer Review Board

of the Institute of Cost Accountants of India. Thus, auditors

should engage with the companies intending to go for an

IPO and take note of the amendments introduced by the

ICDR Amendment Regulations.