Accounting updates

Update from IASB

In December 2021, the Organisation for Economic Co-operation and Development (OECD) published Tax Challenges Arising from the Digitalisation of the Economy – Global Anti-Base Erosion Model Rules (Pillar Two): Inclusive Framework on BEPS (the Rules). The Rules were introduced with the objective to address the tax challenges arising from the digitalisation of economy by ensuring that large multinational groups10The minimum tax rate of 15 per cent would be applicable to multinational groups having consolidated revenues of EUR750 million or more in at least two of the preceding four years pay a minimum amount of tax (i.e., 15 per cent) on income arising in each jurisdiction in which they operate.

Over time, various concerns were raised by the stakeholders regarding the potential implications of the Rules. In particular, uncertainty over the accounting for deferred taxes arising from the Rules was identified as a key challenge area. Thus, in order to address these concerns, the International Accounting Standards Board (IASB), on 9 January 2023, issued an Exposure Draft (ED), International Tax Reform – Pillar Two Model Rules (Proposed amendments to IAS 12). Based on the feedback and representations received from various stakeholders, recently, IASB issued certain amendments to the International Accounting Standard (IAS) 12, Income Taxes. These include:

- Temporary exception to the accounting for deferred taxes arising from the implementation of the Rules: The amendments specify that an entity should not recognise or disclose information about deferred tax assets and liabilities arising from the implementation of the Rules. However, the entity should disclose the fact that it has applied this exception. The exception11 It is mandatory for the companies to apply this temporary exception would be effective immediately upon issuance of the amendments and retrospectively in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors.

-

Disclosure requirements:

IASB has specified certain disclosures, which includes both quantitative and qualitative information which would enable users of the

financial statements understand the company’s exposure to pillar-two income taxes at the reporting date12

Following disclosures are required in this regard:

Once tax law is enacted but before top-up tax is effective:

• Qualitative information: How the company is affected by Pillar Two taxes and in which jurisdictions the exposure arises – for example, where the top-up tax is triggered and where it will need to be paid

• Quantitative information:The proportion of profits that may be subject to Pillar Two income taxes and the average Effective Tax Rate (ETR) applicable to those profits, or how the average ETR would have changed if Pillar Two legislation had been effective.

After top-up tax is effective: Only one disclosure is required – i.e., current tax expense related to top-up tax . These would be effective for the annual reporting periods beginning on or after 1 January 2023.

To access the text of the amendments, please click here

Action Points for Auditors

Pillar Two taxes is a significant reform undertaken by the OECD, with an aim to transform the sphere of international taxation and address certain ambiguities arising out of the digitalisation of the economy. Under this, the ultimate parent entity of the group would be required to pay top-up tax, in the jurisdiction in which it is domiciled, with respect to profits of its subsidiaries that are taxed below 15 per cent. Thus, auditors of companies which would be impacted by Pillar Two reforms and are required to prepare their financial statements in accordance with IFRS should take note of the amendments introduced. Auditors should also engage with such companies for complying with the disclosure requirements in the financial statements for the year ending 31 December 2023.

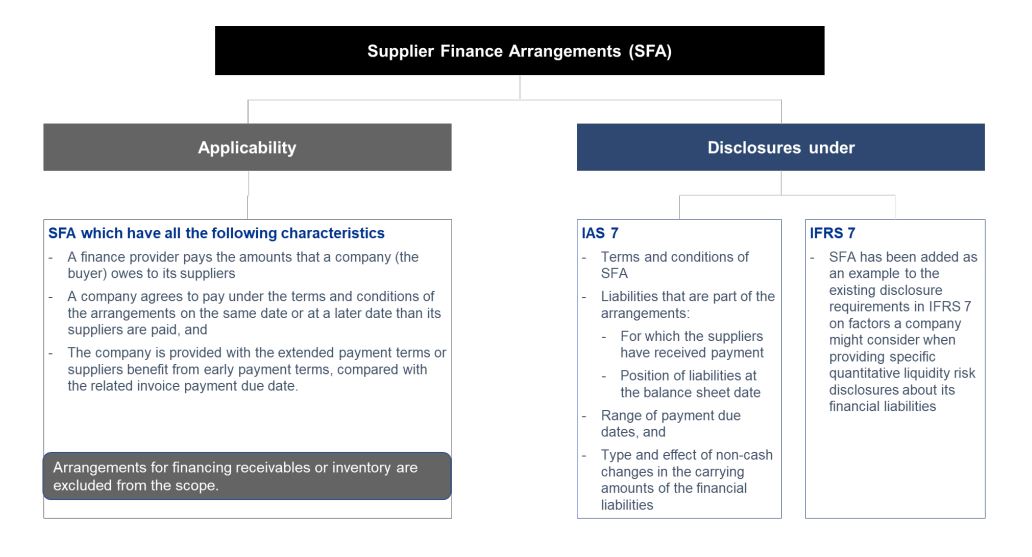

On 25 May 2023, the International Accounting Standards Board (IASB) issued certain amendments to IAS 7, Statement of Cash Flows and IFRS 7, Financial Instruments: Disclosures. The amendments have been issued basis the agenda decision issued by the IFRS Interpretations Committee in December 2020 and the subsequent Exposure Draft (ED) on supplier finance arrangement13Supplier finance arrangements are also referred to as supply chain finance, trade payables finance or reverse factoring arrangements , issued by the IASB. Some of the key amendments and clarifications introduced are illustrated using the given diagram:

(Source: Foundation for Audit Quality’s analysis, 2023)

Effective date: The amendments are effective for the periods beginning on or after 1 January 202414The amendments provide relief from disclosing certain information in the year of initial application, with early application permitted.

Action Points for Auditors

Companies may be required to collate certain additional information for complying with the new disclosure requirements, for example the carrying amount of financial liabilities for which suppliers have already received payment from finance providers. Thus, auditors should actively engage with the companies who have an IFRS reporting, regarding the amendments introduced for ensuring smooth transition to the new requirements.

Since Ind AS are converged with IFRS, similar amendments would be expected in Ind AS as well.

Our Insights

Tools and Enablers

- Standard workpapers

- Technology tools

Resources

- Regulatory updates

-

India updates

Accounting updates

Auditing updates

Regulatory updates

-

International updates

Accounting updates

Auditing updates

Regulatory updates

-

Recap on key updates

-

Publications

India Publications

International Publications

-

Matter for auditors’ attention

-

Discussion/Consultation papers and Publications issued by regulators

India Publication

International Publication

Exposure Drafts/consultation papers

EDs/consultation papers

Matters for Consultation