Auditing updates

Update from IAASB

The International Auditing and Assurance Standards Board (IAASB) has released non-authoritative guidance on fraud in an audit of financial statements, The Fraud Lens –Interactions Between ISA 240 and Other ISAs. The guidance has been developed by the Fraud Task Force of the IAASB to explain the relationship between, and linkage of, International Standards on Auditing (ISA) 240, The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements, and other ISAs when conducting an audit.

Since IAASB recently approved a project proposal to revise ISA 240 in order to enhance or clarify an auditor’s responsibilities with respect to fraud in an audit of financial statements, the guidance illustrates the application of ISA 240 in conjunction with the other ISAs such as ISA 2008, 3159, 33010, 55011 and so on.

- Overall Objective of the Independent Auditor, and the Conduct of an Audit in Accordance with International Standards on Auditing

- Identifying and Assessing the Risks of Material Misstatement

- The Auditor’s Responses to Assessed Risks

- Related Parties

To access the text of the guidance, please click here

Action points for auditors

A clear understanding of the relationship between, and linkage of ISA 240 and the other ISAs would assist the auditors to apply a fraud lens when planning and performing audit procedures, thus ensure fraud-related audit procedures are embedded throughout the audit process. This would ultimately help the auditors in fulfilling their responsibilities under ISA 240 and other ISAs effectivelyIn December 2020, IAASB had released ISA 220 (Revised), Quality Management for an Audit of Financial Statements. One of the key changes introduced in ISA 220 (Revised) related to the definition of Engagement Team (ET), so as to improve quality management at the overall firm and engagement level. The revised definition of ET in ISA 220 (Revised) is as follows:

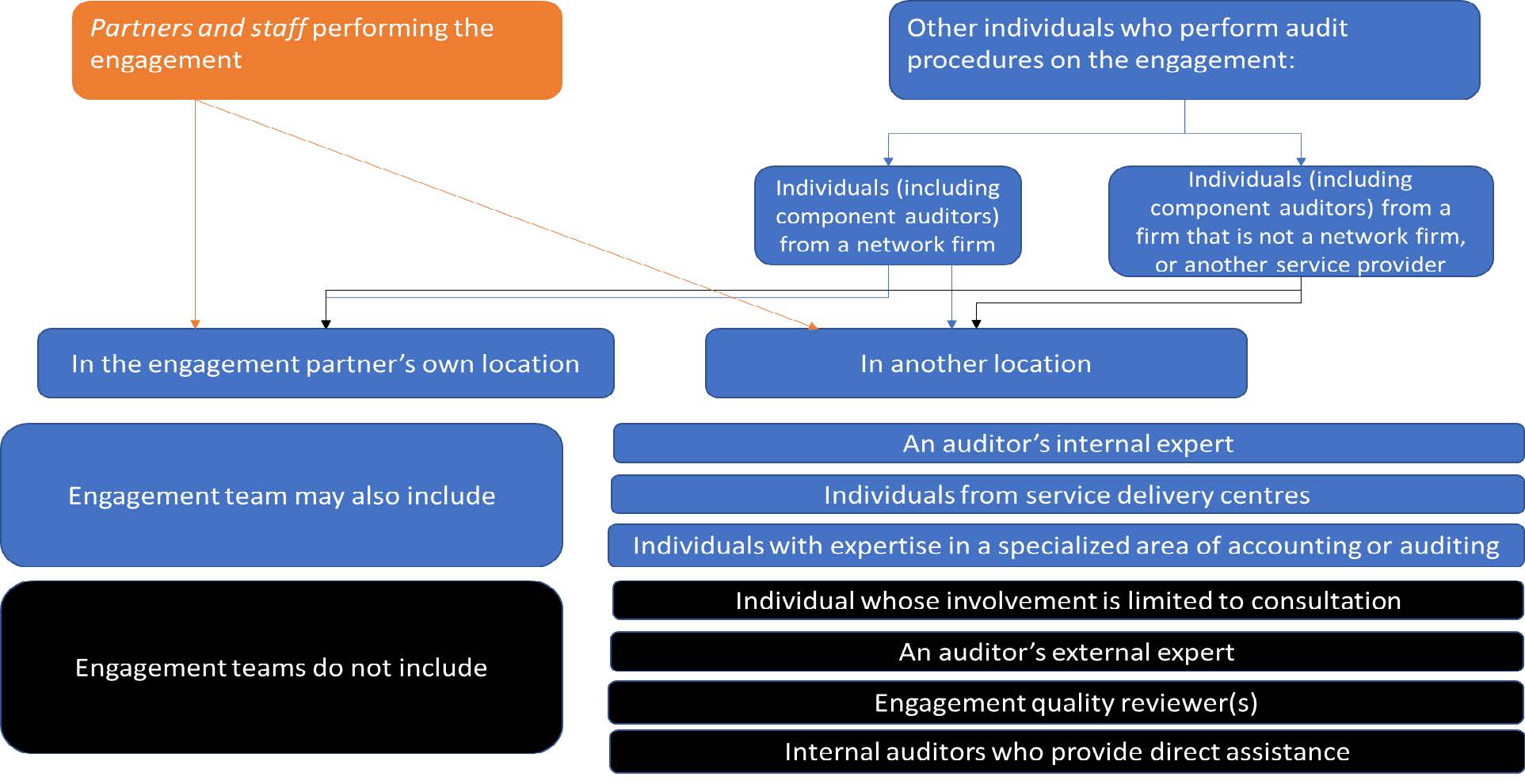

All partners and staff performing the audit engagement, and any other individuals who perform audit procedures on the engagement, excluding an auditor’s external expert12 and internal auditors who provide direct assistance on an engagement13.

This revision ensured that all individuals, regardless of their location or employment status, who have performed audit procedures on the engagement, would be considered as part of the ET.

To help users of its standards adapt to the clarified and updated definition of ET, IAASB has released a new fact sheet. The new fact sheet addresses the clarified definition and its possible impacts, including recognition of the fact that ETs may be organised in a variety of ways, including across different locations or by the activity they are performing. The fact sheet also includes a diagram that walks users through the specific inclusions and exclusions from the definition, as is given in the next page.

(Source: ISA 220 (Revised), Definition of Engagement Team, fact sheet issued by IAASB, May 2022)

- ISA 620, Using the Work of an Auditor’s Expert, paragraph 6(a), defines the term “auditor’s expert”.

- ISA 610 (Revised 2013), Using the Work of Internal Auditors, establishes limits on the use of direct assistance. It also acknowledges that the external auditor may be prohibited by laworregulation from obtaining direct assistance from internal auditors. Therefore, the use of direct assistance is restricted to situations where it is permitted.

Action points for auditors

- In coordination with the IAASB, the International Ethics Standard Board for Accountants (IESBA) is undertaking a project to align the definition of ET in the Code with the revised definitions of the same term in ISA 220 (Revised) and ISQM 1, Quality Management for Firms that Perform Audits or Reviews of Financial Statements, or Other Assurance or Related Services Engagements. The project is also addressing the implications of the change to the ET definition from an independence perspective. Thus, the auditors should consider the impact of the revised definition in conjunction with the IESBA proposals with regard to their independence requirements for audits to be conducted under ISAs. This might result in deployment of updated policies and procedures, awareness raising and training initiatives. Thus, auditors should evaluate the impact of the proposed changes on their overall policy framework.

- The definition of an engagement team under SA 220, Quality Control for an Audit of Financial Statementsis different as compared to the definition of engagement team as defined in ISA 220. As per SA 220, engagement team includesall personnel14performing an engagement, including any experts contracted by the firm in connection with that engagement. The term “engagement team” excludes individuals within the client’s internal audit function who provide direct assistance on an audit engagement when the external auditor complies with the requirements of SA 610 (Revised).

Auditors performing engagements in accordance with ISAs, or auditors acting as component auditors, in a group audit where the principal auditor is based in a country outside India and is required to comply with provisions of ISA 220 should take note of these amendments and comply with relevant independence requirements.

Our Insights

Tools and Enablers

- Standard workpapers

- Technology tools

Resources

- Regulatory updates

-

India updates

Accounting updates

Auditing updates

Regulatory updates

-

International updates

Accounting updates

Auditing updates

Regulatory updates

-

Recap on key updates

-

Publications

India Publications

International Publications

-

Matter for auditors’ attention

-

Discussion/Consultation papers and Publications issued by regulators

India Publication

International Publication

Exposure Drafts/consultation papers

EDs/consultation papers

Matters for Consultation