Regulatory updates

Updates from SEBI

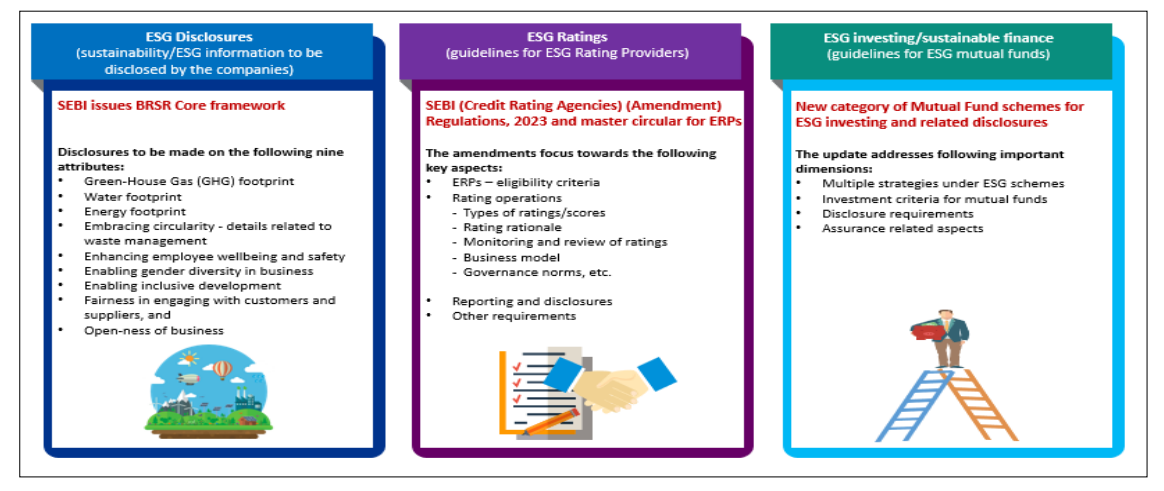

Over the years, there has been a growing emphasis towards Environmental Social Governance (ESG) practices by companies. The stakeholders today give due consideration to non-financial information aspects, alongside financial information and disclosures while making investment and other key decisions. In this regard, regulators around the globe are coming out with various regulations and guidelines to address different aspects and challenges in the ESG space.

On 20 July 2023, SEBI issued a circular for mutual funds, implementing some key measures to facilitate green financing with a thrust on enhanced disclosures and mitigation of green washing risk (the circular). The key developments made in the circular are explained in the below diagram:

(Source: Foundation for Audit Quality’s analysis, 2023 read with the SEBI notifications dated 5 July 2023, 12 July 2023 and 20 July 2023 respectively)

An overview of the key updates has been discussed below:

In May 2021, SEBI had introduced the Business Responsibility and Sustainability Reporting (BRSR), thereby requiring top 1,000 listed entities (by market capitalisation) to file BRSR as part of the Annual Report from FY 2022-23 onwards. BRSR comprises of disclosures which require these listed entities to report on their performance against the nine principles as per the ‘National Guidelines on Responsible Business Conduct’ (NGBRCs).

However, with the growing significance of sustainability disclosures among the investors and other stakeholders’ groups, SEBI observed a need for the entities to obtain assurance on these disclosures. On 12 July 2023, SEBI issued the BRSR Core framework (the framework), specifying the disclosure and assurance requirements for BRSR Core, ESG disclosures for value chain, and related assurance requirements. The key aspects of the framework are stated below:

- BRSR Core: BRSR Core is a sub-set of the comprehensive BRSR format, and consists of a set of Key Performance Indicators (KPIs)/metrics under the nine ESG attributes as specified below:

- Green-House Gas (GHG) footprint

- Water footprint

- Energy footprint

- Embracing circularity - details related to waste management

- Enhancing employee wellbeing and safety

- Enabling gender diversity in business

- Enabling inclusive development

- Fairness in engaging with customers and suppliers, and

- Open-ness of business.

The reporting format in the framework consists of:

- Annexure I: Provides the format for BRSR Core

- Annexure II: Provides the revised BRSR format after incorporating the additional KPIs based on nine attributes of BRSR Core, and

- Corresponding amendments have been made to the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR Regulations).

BRSR Core is applicable to the top 1,000 listed entities (by market capitalisation), and they are required to provide the relevant disclosures as part of the annual report from FY 2023-24.

Further, the framework states that the listed entities should obtain a mandatory reasonable assurance on the BRSR Core and disclosures by an independent assurance provider, basis the following glide path:

- FY 2023-24: Reasonable assurance mandatory for top 150 companies

- FY 2024-25: Reasonable assurance mandatory for top 250 companies

- FY 2025-26: Reasonable assurance mandatory for top 500 companies, and

- FY 2026-27: Reasonable assurance mandatory for top 1000 companies.

- ESG value chain: The framework provides that a listed entity should report the parameters as per BRSR Core for their value chain to the extent it is attributable to their business with that value chain partner. Some key points in this regard include:

- Applicability: The ESG disclosures for the value chain are applicable to the top 250 listed entities (by market capitalisation), on a comply-or-explain basis from FY 2024-25

- Composition of value chain: It has been specified that an entity’s value chain should encompass the top upstream and downstream partners, cumulatively comprising 75 per cent of its purchases/sales (by value) respectively

- Reporting format: Disclosures for value chain should be made by the listed entity as per the BRSR Core, as part of its annual report, and

- Limited assurance: Such companies should obtain limited assurance on a comply or-explain basis from FY 2025-26.

- Assurance provider – key requirements: The framework states that a listed entity, while appointing an assurance provider should ensure that it has the necessary expertise, for undertaking assurance. Further, it should ensure that there is no conflict of interest with the assurance provider appointed (for detailed explanation on the list of allowed and prohibited services by the assurance provider, please refer the FAQs specified below).

SEBI FAQs on BRSR Core

On 8 August 2023, SEBI issued certain Frequently Asked Questions (FAQs) on BRSR Core. Some of the key FAQs discussed are as below:

- Who can provide assurance on BRSR Core: It is not mandatory for a Chartered Accountant to provide assurance on BRSR Core. The board of directors of the entity must ensure that the assurance provider has necessary expertise for undertaking reasonable assurance on sustainability information

- What activities/services could lead to conflict of interest: If the assurance provider sells its products or offers any non-audit or non-assurance services to the entity or its group entities (irrespective of whether the nature of product/service is financial or non-financial), then it may lead to a situation of conflict of interest

- What activities can be undertaken by assurance provider: Audit/assurance activities such as providing third-party certifications, tax audit, system audit, tax filing, etc. could be undertaken by the assurance provider. However, activities such as risk management, management and consulting, investment advisory, accounting and book- keeping services etc. are not permissible

- Can internal auditor provide assurance on BRSR Core: No, the internal auditor of an entity or its group entities cannot be appointed as the assurance provider for BRSR Core

- Can statutory auditor provide assurance on BRSR Core: Yes, the statutory auditor of an entity can be appointed as the assurance provider for BRSR Core

- Meaning of the term ‘group’: The term ‘group’ refers to the holding company, subsidiaries, associates and joint ventures of the entity

-

Entities considered as an ‘associate’ of an assurance provider:

- If the assurance provider is a firm/corporate entity: Any of the partners, parent, subsidiaries, associates, and any entity in which the assurance provider, parent or partner has significant influence/control. In case of a CA firm, it would also include all entities in the network firm/network entity of which the assurance provider is a part

- If the assurance provider is an individual: Any immediate relative (as defined in the Companies Act, 2013) and any entity in which such individual has significant influence/control.

- Assurance standard: No specific assurance standard has been mandated/recommended by SEBI. The assurance provider may use ISAE 30001 International Standard on Assurance Engagements (ISAE) 3000, Assurance Engagements Other than Audits or Reviews of Historical Financial Information , SSAE 30002 Standard on Sustainability Assurance Engagements (SSAE) 3000, Assurance Engagements on Sustainability Information or SAE 34103 Standard on Assurance Engagements (SAE) 3410, Assurance Engagements on Greenhouse Gas Statements. Disclosure needs to be made of the relevant assurance standard used.

Action Points for Auditors

- SEBI, through this framework has introduced enhanced disclosures in the BRSR format (issued in May 2021) by incorporating the additional parameters of BRSR Core. Also, certain leadership indicators (which were voluntary disclosures in 2022-23) have now been made mandatory (reclassified as essential indicators). These additional indicators are expected to enhance reporting requirements for the companies. Thus, the auditors along with the management should evaluate the changes that need to be made to the existing BRSR disclosures of the company.

- Considering that the BRSR Core reporting is applicable for the current year (i.e., F.Y. 2023-24), and SEBI has notified the same on 12 July 2023, i.e., after the end of first quarter, companies and auditors must assess any potential data gaps for the period gone by (i.e., from 1 April 2023 till date). They should also evaluate the new parameters to update and strengthen the existing processes and systems so that they capture and report on the ESG data and metrics.

- It must be ensured that there is no conflict of interest with the assurance provider appointed for assuring the BRSR Core. There is a need for the companies and their audit committees to assess the relationships of the potential assurance providers with the entity or its group entities in determining any potential conflicts of interest before appointing the assurance providers.

With an increase in focus towards ESG reporting by the companies, the role of ESG Rating Providers (ERPs) has also got amplified in the overall sustainability space. However, in India, the activities of ERPs were not subject to any regulatory oversight. In this regard, in February 2023, SEBI issued two consultation papers on – ESG Disclosures, Ratings and Investing and Regulatory Framework for ERPs in Securities Market. The consultation papers proposed the need of a regulatory framework for ERPs. Consequently, SEBI notified certain amendments to the SEBI (Credit Rating Agencies) Regulations, 1999 (CRA Regulations), thereby inserting a new chapter – Chapter IVA “ESG Rating Providers” which provides a high-level regulatory framework for ERPs.

Recently, on 12 July 2023, SEBI released a master circular for ERPs (the master circular) which has provided detailed requirements for ERPs and also released certain FAQs on ERPs. Some of the key aspects discussed include:

-

ERPs – eligibility criteria: It has been specified that a person should act as an ERP, only

after it has obtained a certificate of registration from SEBI in this regard. Further, the

application4

The application can be made for seeking registration in any of the following two categories:

‐ Category I, or

‐ Category II. for the grant of registration certificate has to be made in Form A of the Fifth Schedule to the CRA Regulations. Some of the important eligibility criteria prescribed include:

- The applicant must be incorporated as a company under the Companies Act, 2013

-

The applicant should have specified ESG rating activity, as the main object in5

However, an ERP may following other activities:

‐ ESG rating of any product/issuer, as required by any other financial sector regulator or authority

‐ Research activities which are incidental to ESG rating – including research for economy, environment and ecology, society and social issues, etc.

‐ Client-group level segregation for ESG ratings and/or green debt certifications. For this purpose, ‘client group’ would include the client company of an ERP along with all the group companies of such client. However: • An ERP must offer only one of these services – ‘ESG ratings/certification of green debt securities’, or ‘audit of financial statements/assurance of sustainability disclosures’, and

• If an ERP wants to migrate from one service offering to another, a cooling period of one year has been prescribed. its Memorandum of Association - The applicant must have submitted to SEBI, its business plan w.r.t. providing ESG ratings, along with information such as – target breakeven date, target revenue, target number of clients, cumulative cash losses that it projects to incur until the targeted breakeven date, etc.

The following table summarises the applicability of Chapter IVA to ERPs under different scenarios:

| Scenario | Location of ERP | Asset class in securities market | Location of ESG rating user | Applicability of Regulations |

|---|---|---|---|---|

| A | India | Indian | India | Yes |

| B | India | Indian | Outside India | No |

| C | India | Global | India | Yes |

| D | Outside India | Indian | India | Yes |

| E | Outside India | Indian | Outside India | No |

| F | Outside India | Global | India | No |

- Rating operations: Some of the significant guidelines w.r.t. rating operations of ERPs include:

- Types of ratings/scores: The CRA Regulations define ESG ratings as: “the rating products that are marketed as opinions about an issuer or a security, regarding its ESG profile or characteristics or exposure to ESG risk, governance risk, social risk, climatic or environmental risks, or impact on society, climate and the environment, that are issued using a defined ranking system of rating categories, whether or not these are explicitly labelled as “ESG ratings”. An ERP should offer at least the following rating products:

- ESG rating

- Transition/parivartan score6 ESG transition/parivartan score measures the velocity of and investments in making the transition to net zero goals/improving ESG risk management. It reflects the incremental changes that the company has made in its transition story over recent years or concrete plans/targets to address the risk and opportunities involved in transitioning to more sustainable operations, rather than scoring them only on their current profile

- Combined score7 Combined score incorporates the ESG rating and transition rating, i.e., measuring both the status and ability to transition should also be provided. It is determined in the following manner: (ESG score + transition or parivartan score = Combined score)

- Core ESG rating8 Core ESG rating would be based on third-party assured or audited data disclosed by the company

- Core transition/parivartan score

- Core combined score9 Core combined score incorporates core ESG rating and core transition rating. It is determined in the following manner: (Core ESG score + Core transition or parivartan score = Core combined score)

It is mandatory for ERPs to provide a rating score on a scale from 0 to 100, wherein, 100 represents the maximum score.

- Rating rationale: It has been provided that the ESG rating rationale/ESG report may contain the following minimum disclosures:

- Current ESG rating/score

- Change in rating/score from the previous evaluation

- Last review date

- Summary of key drivers – both qualitative (including controversies and their impact) and quantitative, considered for arriving at the overall ESG rating

- Pillar wise E, S and G scores – key drivers (including industry comparison of material parameters) – both quantitative and qualitative being considered for carrying out such assessment

- Weights of E, S and G scores in the assigned ESG rating

- Brief explanation of rating intent to clarify if it represents unmanaged risks/performance against risks/impact etc., and

- Summary of or link to the methodology used.

- Monitoring and review of ratings: The master circular provides that an ERP should, on an annual basis undertake a review of the decisions taken by it in that year. Hence, it should have an efficient system to track material developments10 Material developments are events which result in a change in the ESG profile of the rated company, such as the publication of BRSR or any controversy/penalty in ESG areas related to ESG factors, as required under Regulation 28L(g) of the CRA Regulations and carry out a review of the ESG ratings upon the occurrence of or announcement/news of such material developments, within 10 days of the occurrence of such event. Ratings may be withdrawn from by the ERP in certain circumstances as prescribed by the master circular.

- Business model:These include: ERPs should follow either the ‘subscriber-pays’ business model11 In this model, the ERP would derive its revenue through ESG ratings from subscribers that may include banks, insurance companies, pension funds, or the rated entity itself or ‘issuer-pays’ business model12 In this model, the ERP would derive its revenues through ESG ratings from the rated entity . However, they should not follow a hybrid business model9, i.e., assigning certain ESG ratings based on issuer-pay model, while assigning others based on a subscriber-pays model. For an issuer-pays business model, specific guidelines have also been prescribed by the master circular where the issuer does not cooperate with the information or other requirements.

- Governance norms:These include:

- Managing Director (MD)/Chief Executive Officer (CEO) of an ERP and any other person who has a business responsibility must not interfere in the determination of ESG rating

- At least one third of the board of an ERP should comprise of independent directors, if the board is chaired by a non-executive director. Where the board is chaired by an executive director, at least half of the board should comprise of independent directors

- The board of an ERP must constitute an ESG ratings sub-committee and nomination and remuneration committee

- The rating team should report to a Chief Ratings Officer (CRO).

- Reporting and disclosures:The master circular prescribes two types of disclosure requirements for the ERPs – periodic (annual) disclosures [to be made within 30 days from the end of the F.Y.] and continuous disclosures [to be kept available on the website at all times]. Some of the key disclosure requirements include:

- Periodic disclosures

- Disclosures on ESG rating history and movement

- Disclosures on average rating transition rates

- Income of ERPs, etc.

- Continuous disclosures

- Disclosure of guidelines/policies adopted for dealing with conflict of interest

- Shareholding pattern as prescribed by stock exchange(s) for a listed company under Regulation 31 of the SEBI LODR Regulations

- In case of any delay in carrying out the periodic review, the details of all such ratings where the review became due but was not completed within the due date, including the name of company, security type (if applicable), date of last review, reasons for delay, hyperlink to the last rating rationale, etc.

- Other requirements: Other key requirements w.r.t. ERPs include:

- Internal audit for ERPs: Internal audit of ERPs should be conducted on a yearly basis by Chartered Accountants, Company Secretaries or Cost and Management Accountants who are in practice and who do not have any conflict of interest with the ERP

- Guidelines on outsourcing of activities by ERPs: The master circular incorporates the principles for outsourcing by ERPs and states that ERPs must not outsource their core business activities and compliance functions

- Firewall between ERPs and their affiliates: Several measures have been mandated to strengthen the firewall between ERPs and non-ERP entities (i.e., associate or subsidiary or group entity of the ERP). These include - formulating a policy on separation or firewall practices with the non-ERP entities, disclosure on the website, the details of any common director or the Chief Executive Officer (CEO) or Managing Director (MD) between the ERP and the non-ERP entity, etc.

To access the text of the SEBI CRA (Amendment) Regulations, 2023, please click here

To access the text of the master circular for ERPs, please click here

To access the text of the FAQs on ERPs, please click here

Action Points for Auditors

The master circular specifies that internal audit of ERPs should be conducted on a yearly basis by Chartered Accountants, Company Secretaries or Cost and Management Accountants, who are in practice and who do not have any conflict of interest with the ERP. Thus, members of the profession may engage with the ERP companies for rendering internal audit services provided they meet the qualification criteria prescribed by the master circular.

In recent times, sustainable finance has emerged as an important topic of discussion among the various stakeholder groups globally. There are many means of sustainable/ESG finance today – such as green bonds, green deposits, transition bonds, amongst others. ESG schemes of mutual funds have also emerged as popular mode of ESG investing among the investors.

On 20 July 2023, SEBI issued a circular, introducing a new category of mutual fund schemes for ESG investing and the related disclosure requirements. The circular addresses following key dimensions:

- Multiple strategies under ESG schemes: As per the existing regulations, mutual funds could launch only one ESG scheme under the thematic category of equity schemes. However, SEBI has now introduced a separate sub-category for ESG investments under the thematic category of equity schemes, by including various strategies that the mutual funds can adopt to align their investments with ESG considerations. Some of the strategies specified in this regard include:

- Exclusion: It involves excluding securities based on certain ESG-related activities, business practices, or business segments. The exclusions can be based on factors such as adverse impact, controversy, faith etc.

- Best-in-class and positive screening: This strategy aims to invest in companies and issuers that outperform their peers on one or more ESG performance metrics

- Impact investing: The funds based on this strategy should seek a non-financial (real world) impact and evaluate if the impact is being measured and monitored

- Others: Others include best-in-class and positive screening, sustainable objectives and transition or transition related investments. Further, SEBI has mandated that at least 80 per cent of the total Assets Under Management (AUM) of the ESG scheme should be invested in equity and equity related instruments of the chosen strategy. Also, the remaining portion should not contradict the strategy of the scheme. These provisions are applicable with immediate effect, i.e., 20 July 2023.

- Investment criteria: ESG schemes of mutual funds must invest at least 65 per cent of the AUM in companies which are reporting on comprehensive BRSR and are also providing assurance on the BRSR Core disclosures. The balance AUM may be invested in companies having BRSR disclosures. This requirement will be applicable w.e.f. 1 October 202413 However, in case of non-compliance by ESG schemes with the specified investment criteria by 1 October 2024, an extension period has been prescribed till 30 September 2025 to ensure compliance. However, ESG schemes cannot undertake any fresh investments in companies without assurance on BRSR Core during the extended period of one year .

- Disclosure requirements: The amendments have prescribed certain key disclosure requirements w.r.t. ESG mutual fund schemes. These include:

- Scheme strategy

- ESG scores of securities

- Voting disclosures

- Annual fund manager commentary

- Assurance: With regard to assurance and certification requirements, SEBI has prescribed that:

- An independent reasonable assurance would be required on an annual basis for AMCs w.r.t. compliance of ESG scheme’s portfolio with the strategy and objective of the scheme stated in Scheme Information Documents (SIDs). Such assurance is applicable on a “comply or explain basis” for all ESG schemes for FY 2022-23 by 31 December 2023. Thereafter, disclosure of assurance should mandatorily be made in the scheme’s annual report

- Basis a comprehensive internal ESG audit, the Board of Directors of AMCs are required to certify compliance of ESG schemes with the regulatory requirements as a part of the annual report of the scheme. They should provide the certificate for 2022-23 by 31 December 2023. Thereafter, the certification should be disclosed in the annual report of the scheme.

To access the text of the SEBI circular, please click here

Action Points for Auditors

SEBI, vide the FAQs dated 8 August 2023 has provided clarifications on certain matters pertaining to assurance providers of BRSR Core. Both, the BRSR Core Framework and the ESG investing framework have similar qualification requirements for assurance providers. Both the frameworks require the assurance provider to:

- Have the necessary expertise for undertaking reasonable assurance

- Not have any conflict of interest with the company- i.e., the assurance provider or any of its associates should not sell its products or provide any non-audit/non-assurance related service including consulting services, to the AMC or its group entities.

In the absence of similar clarifications for assurance providers of ESG schemes, the ESG providers for ESG Schemes can refer to these FAQs apart from other independence considerations.

Regulation 23(6) of the SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 (NCS Regulations) states that an issuer which is a company under the Companies Act, 2013 (the 2013 Act) must ensure that its Articles of Association (AoA) require the Board of Directors to appoint as director, a person nominated by the debenture trustee(s).

However, based on the representations received from various stakeholders, the Securities and Exchange Board of India (SEBI) observed that while the aforementioned obligation exists for the issuers which are companies under the 2013 Act, there was no similar obligation for the issuers that are not companies.

Entities that are incorporated under a different statute, would face challenges in executing similar amendments as the composition of their board of directors is governed by certain statutes which do not provide for appointment of a nominee director. Further, there are similarities in roles and responsibilities of directors and nominee directors.

Considering these factors, SEBI issued a circular on 4 July 2023 that requires entities that are incorporated under a different statute to submit an undertaking to their Debenture Trustees that in case of events as mentioned in Regulation 15(1)(e) of SEBI (Debenture Trustees) Regulations, 199314 Regulation 15(1)(e) of the SEBI (Debenture Trustees) Regulations, 1993 requires every debenture trustee to appoint a nominee director on the Board of the company in the event of: i. Two consecutive defaults in payment of interest to the debenture holders; or ii. Default in creation of security for debentures; or iii. Default in redemption of debentures. , a non-executive /independent director / trustee / member of its governing body shall be designated as nominee director for the purposes of Regulation 23(6) of NCS Regulations, in consultation with the Debenture Trustee, or, in case of multiple Debenture Trustees, in consultation with all the Debenture Trustees.

Effective Date: The provisions of the circular are applicable with immediate effect, i.e., 4 July 2023.

To access the text of the circular, please click here

On 7 July 2023, SEBI issued a circular regarding the roles and responsibilities of trustees and board of directors of Asset Management Companies (AMCs) of mutual funds. The circular prescribes the core responsibilities for the trustees of a mutual fund. Some of these are discussed below:

- Due diligence: The circular specifies certain matters where the trustees should exercise due diligence. These include:

- Fairness of the fees and expenses charged by the AMCs

- Review of the performance of AMC’s schemes against the performance of peers or the relevant benchmarks

- No undue or unfair advantage is given by the AMCs to any of the associates/group entities

- AMC has put in place adequate systems to prevent misconduct by the employees, AMC or the connected entities of the AMCs, etc.

- Evaluation of compliance by AMCs: The circular states that the trustees and their resource persons must independently evaluate the extent of compliance by AMCs w.r.t. the identified key areas and not just rely on the external assurances.

- KYC updation: The trustees should periodically review the steps taken by the AMCs for folios which do not contain all the Know Your Client (KYC) attributes and ensure that remedial steps are taken for updating the same.

Further, the circular specified following additional requirements:

- Third party assurances: In order to focus on the aforementioned core responsibilities, the trustees may rely on professionals, such as – audit firms, legal firms, merchant bankers, etc. for carrying out due diligence on behalf of the trustees

- Appointment of the trustee company: In cases where a company is appointed as the trustee of a mutual fund, the chairperson of the board of directors of the company must be an independent director. In this regard, the existing trustee companies must ensure compliance with this requirement within a period of six months from the date of the circular coming into force, i.e., 1 January 2024

- Meetings between the trustee company and AMC: The circular provides that the board of directors of the AMCs and the trustee company should meet at least once in a year to discuss the issues concerning the mutual fund, if any.

Effective Date: The circular would come into force w.e.f. 1 January 2024.

To access the text of the circular, please click here

Our Insights

Tools and Enablers

- Standard workpapers

- Technology tools

Resources

- Regulatory updates

-

India updates

Accounting updates

Auditing updates

Regulatory updates

-

International updates

Accounting updates

Auditing updates

Regulatory updates

-

Recap on key updates

-

Publications

India Publications

International Publications

-

Matter for auditors’ attention

-

Discussion/Consultation papers and Publications issued by regulators

India Publication

International Publication

Exposure Drafts/consultation papers

EDs/consultation papers

Matters for Consultation