Regulatory updates

Updates from SEBI

Regulation 36(1)(b)20Applicable to issuers of specified securities of the SEBI (Listing Obligations and Disclosure Requirement) Regulations, 2015 (LODR Regulations) requires companies to send the hard copy of their annual report containing salient features of all the documents prescribed in Section 136 of the Companies Act, 201321 As per Section 136 of the Companies Act, 2013, a copy of the financial statement, including consolidated financial statements, if any, auditor’s report and every other document required by law to be annexed or attached to the financial statements, which are to be laid before a company in its general meeting, shall be sent to every member of the company , to every trustee for the debenture-holder of any debenture issued by the company, and to all persons other than such member or trustee, being the person so entitled, not less than twenty-one days before the date of the meeting. to the shareholders who have not registered their email addresses with the company. Additionally, Regulation 58(1)(b)22Applicable to issuers of non-convertible securities of the LODR Regulations requires companies with listed Non-Convertible Securities (NCS) to send the hard copy of their annual report to the holders of NCS who have not registered their email addresses with the company.

MCA, vide circular dated 28 December 2022 had extended the relaxations from dispatching of physical copies of financial statements for the Annual General Meetings (AGMs) conducted till 30 September 2023. In view of the same, SEBI also received multiple representations from the listed companies, seeking dispensation from the requirements of sending hard copy of the annual reports to their shareholders as well as holders of NCS. Accordingly, SEBI, vide two circulars, both dated 5 January 2023 has decided to extend the relaxation from complying with Regulation 36(1)(b) and Regulation 58(1)(b) of the LODR Regulations up to 30 September 2023 (earlier this exemption was available till 31 December 2022).

However, it has been clarified that the notice of the AGM published by an advertisement in terms of Regulation 47 of the LODR Regulations, should contain a link to the annual report, so as to enable shareholders to have access to the full annual report. It has been emphasized that in terms of Regulation 36(1)(c) of the LODR Regulations, listed entities would be required to send a hard copy of full annual report to those shareholders who request for the same.

Effective date: The circular would come into effect on an immediate basis.

To access the text of the SEBI circulars, please click 1 and 2

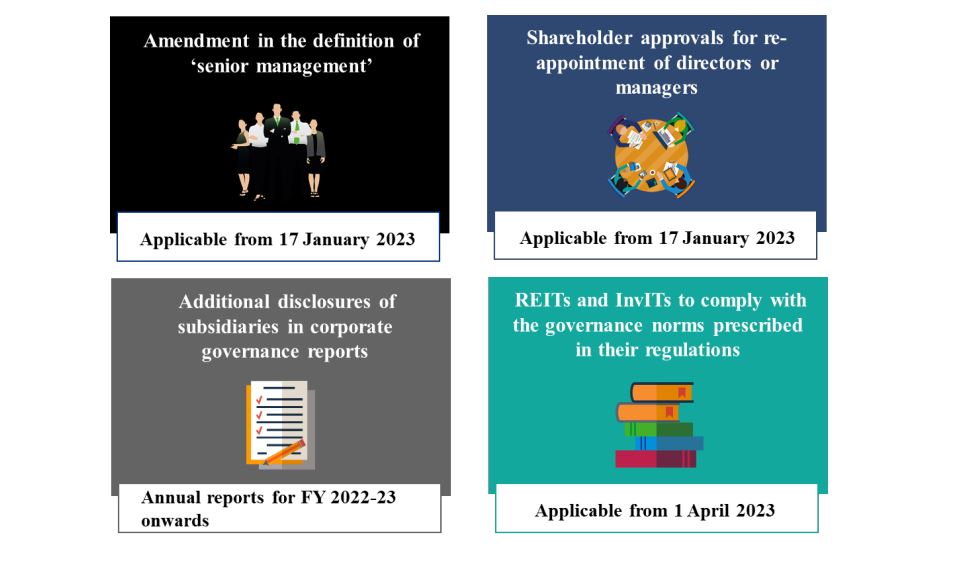

On 17 January 2023, SEBI issued the SEBI (LODR) Amendment Regulations, 2023 (the amendment). The key amendments introduced are with regard to the following:

(Source: Foundation for Audit Quality’s analysis, 2023 read with SEBI (LODR) Amendment Regulations, 2023)

These amendments are further explained in the below paragraphs.

- Amendment in the definition of ‘senior management’: Regulation 16(1)(d) of the LODR Regulations defines ‘senior management’ as: “officers/personnel of the listed entity who are members of its core management team excluding board of directors and normally this shall comprise all members of management one level below the chief executive officer/managing director/whole time director/manager (including chief executive officer/manager, in case they are not part of the board) and shall specifically include company secretary and chief financial officer” In addition to the persons specifically mentioned in the definition above, the amendment has now also included the functional heads of a company within the definition of senior management.

- Shareholder approvals for re-appointment of directors or managers: Regulation 17(1C) of the LODR Regulations states that a listed entity should obtain an approval of the shareholders for appointing a person on the Board of Directors or as a manager at the next general meeting or within a period of three months from the date of appointment, whichever is earlier. It is to be noted that this provision was applicable only for appointment and not re-appointment of a person. The amendments have now made the requirement to obtain shareholder approval within the stipulated timeline applicable even in case of re-appointment of a person on the Board of Directors or as a manager. Further, the amendment has clarified that in case of a public sector company, the approval of the shareholders for appointment or re-appointment of a person on the Board of Directors or as a manager should be taken in the next general meeting (i.e., the three months’ time period criteria has now been omitted for the appointment or reappointment in case of a public sector company).

- Additional disclosures of subsidiaries in corporate governance reports: Part C of Schedule V of the LODR Regulations prescribes the disclosures that are required to be made by a company in the corporate governance report of the company. In addition to the existing disclosure requirements, companies should now disclose details of its material subsidiaries, including the date and place of incorporation and the name and date of appointment of the statutory auditors of such subsidiaries23 This disclosure is required to be provided in the ‘Other Disclosures’ section of the corporate governance report which is prescribed by Part C(10) of Schedule V of the LODR Regulations . This disclosure requirement would be applicable for the annual reports filed for the FY 2022-23 and thereafter.

- REITs and InvITs to comply with the governance norms prescribed in their regulations: Explanation 4 to Regulation 15 of the LODR Regulations provides that in case of a High Value Debt Listed Entity (HVDLE)24HVDLEs are the entities that have listed non-convertible debt securities and have an outstanding value of listed nonconvertible debt securities of INR500 crore and above. which is a Real Estate Investment Trust (REIT) or an Infrastructure Investment Trust (InvIT), the Board of the manager or the investment manager of the REIT and InvIT respectively, should comply with the corporate governance provisions, as specified in the LODR Regulations. The amendment has now removed this requirement and states that the corporate governance norms for REITs and InvITs should be aligned with the corresponding provisions of the SEBI (REIT) Regulations, 2014 and SEBI (InvIT) Regulations, 2014 respectively. The amendment would be applicable w.e.f. 1 April 2023.

To access the text of the amendments, please click here

Action Points for Auditors

Auditors should take note of the amendments introduced and evaluate their impact on the companies, particularly with regard to the additional disclosure requirements required in the corporate governance reports, as well as the revised corporate governance norms in case of REITs and Invites.

On 17 January 2023, SEBI notified the SEBI (Change in Control in Intermediaries) (Amendment) Regulations, 2023 (the amendment). The amendment has substituted the definition of “change in control” in the following Regulations:

- SEBI (Stock Brokers) Regulations, 1992

- SEBI (Merchant Bankers) Regulations, 1992

- SEBI (Debenture Trustees) Regulations, 1993

- SEBI (Registrars to an Issue and Share Transfer Agents) Regulations, 1993

- SEBI (Bankers to an Issue) Regulations, 1994

- SEBI (Custodian) Regulations, 1996

- SEBI (Credit Rating Agencies) Regulations, 1999

- SEBI (KYC (Know Your Client) Registration Agency) Regulations, 2011

- SEBI (Alternative Investment Funds) Regulations, 2012

- SEBI (Investment Advisers) Regulations, 2013

- SEBI (Research Analysts) Regulations, 2014

- SEBI (Depositories and Participants) Regulations, 2018

- SEBI (Portfolio Managers) Regulations, 2020

- SEBI (Vault Managers) Regulations, 2021

As per the revised definition, “change in control” refers to:

-

in case of a body corporate –

- if its shares are listed on any recognised stock exchange, shall be construed with reference to the definition of control in terms of Regulations framed under Clause (h) of Sub-Section (2) of Section 11 of the Act25The Act refers to the SEBI Act,1992,

- if its shares are not listed on any recognised stock exchange, shall be construed with reference to the definition of control as provided in Sub-Section (27) of Section 2 of the Companies Act, 2013 (18 of 2013),

- in a case other than that of a body corporate, shall be construed as any change in its legal formation or ownership or change in controlling interest

Explanation – For the purpose of Sub-Clause (ii), the expression “controlling interest” means an interest, direct or indirect, to the extent of not less than 50 per cent of voting rights or interest.

Effective date: The amendment is effective from the date of its publication in the Official Gazette, i.e., 17 January 2023.

To access the text of the notification, please click here

Our Insights

Tools and Enablers

- Standard workpapers

- Technology tools

Resources

- Regulatory updates

-

India updates

Accounting updates

Auditing updates

Regulatory updates

-

International updates

Accounting updates

Auditing updates

Regulatory updates

-

Recap on key updates

-

Publications

India Publications

International Publications

-

Matter for auditors’ attention

-

Discussion/Consultation papers and Publications issued by regulators

India Publication

International Publication

Exposure Drafts/consultation papers

EDs/consultation papers

Matters for Consultation