International update

Updates from EFRAG

In January 2023, the European Union (EU) published the Corporate Sustainability Reporting Directive (CSRD). The CSRD aims to strengthen the rules regarding social and environmental information that companies have to report on. In this regard, the European Financial Reporting Advisory Group (EFRAG) developed the European Sustainability Reporting Standards (ESRS). The draft zstandards were introduced in November 2022. Subsequently, on 31 July 2023, the final text of the first set of 12 ESRSs got issued.

The ESRSs are aligned with the reporting areas used in the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations. Further, many disclosure requirements are similar to or based on the recommendations and the standards developed by the Global Reporting Initiative (GRI).

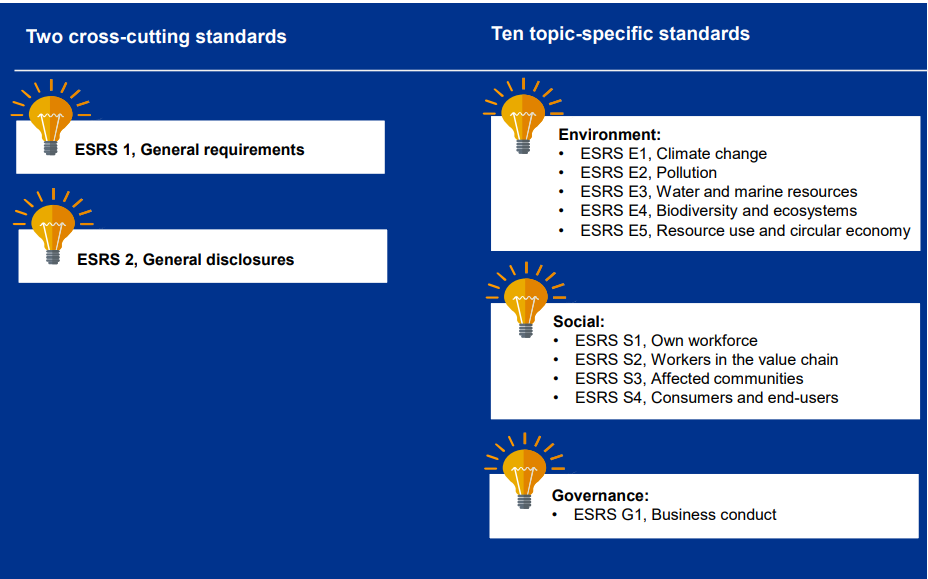

The diagram illustrates the 12 ESRSs issued:

(Source: Foundation for Audit Quality’s analysis, 2023 read with the ESRSs issued by the EFRAG in July 2023)

The following points explain some of the key aspects of the ESRSs:

- Applicability and effective date: ESRSs would be applicable to (group exceptions may apply):

-

Large EU companies which on the balance sheet date,

exceed two of the following three criteria (including EU and

non-EU subsidiaries):

- 250 employees, or

- Net revenue of EUR 40 million, or

- Total assets of EUR 20 million.Total assets of EUR 20 million.

- Companies with listed securities on EU-regulated markets (except micro-undertakings), and

- Ultimate non-EU parent companies with a combined group turnover in the EU of more than EUR 150 million.

The ESRSs would be applicable w.e.f. 1 January 2024. However, they would apply in a phased manner, beginning with the Public Interest Entities (PIEs) and companies with listed securities on EU-regulated markets which are large and have more than 500 employees.

- Concept of double materiality: The standards provide that a company should report sustainability matters based on the concept of double materiality. Double materiality refers to two dimensions of materiality – ‘financial5 Under the ESRSs, financial materiality would require disclosure of sustainability-related matters that (may) trigger material financial effects on a company’s development, such as cash flows, financial position or financial performance in the short, medium or long term ’ and ‘impact6 Under the ESRSs, impact materiality would require disclosure of sustainability-related matters that relate to a company’s material actual or potential, positive or negative impacts on people or the environment over the short, medium, or long term. Materiality would be assessed based on severity and likelihood of the impact. ’ . Accordingly, companies are required to perform materiality assessments for both the dimensions. Therefore, a sustainability matter would meet the criterion of double materiality if it is material from either of the dimension.

- Materiality assessment test: One of the important aspects discussed in the standards is w.r.t. materiality assessment test conducted by the companies. It provides that:

- Irrespective of the outcome of the materiality assessment, a company should always disclose the information required by ESRS 2

- All other standards and individual disclosure requirements and datapoints would be subject to materiality assessment. But in cases wherein companies conclude that ESRS E1 (climate change) is not material, then they should provide a detailed explanation of their conclusion

- In case, a company concludes that a topic other than climate change is not material and omits all the disclosure requirements in the corresponding topical ESRS, it may provide a brief explanation of the conclusion of its materiality assessment for that particular topic.

- Reporting boundary: The ESRS reporting boundary is based on the financial statements, i.e., the sustainability statement would be prepared for the same reporting company, as the financial statements. Further, while preparing the sustainability statement, companies must identify and report on material impacts, risks and opportunities through their direct and indirect business relationships in the upstream and/or downstream value chain.

- Reporting timelines: It has been specified that companies need to prepare a sustainability statement, including the disclosures required by the ESRSs, as part of their management report. The same needs to be published at the same time as the financial statements.

-

Assurance:

CSRD requires assurance across all the topics

in the following manner:

- FY24 (i.e., reporting in 2025): Limited assurance7 Limited assurance refers to a level of assurance at an acceptable level, that based on professional judgement, is meaningful for the intended users. It results in a negative conclusion for certain large companies

- FY25 (i.e., reporting in 2026): Limited assurance for other large companies

- FY26 (i.e., reporting in 2027): Limited assurance for listed Small and Medium Enterprises (SMEs).

Further, companies would be required to undertake reasonable assurance8 Expressing reasonable assurance requires the assurance provider to obtain sufficient appropriate evidence to conclude that the sustainability-related information is prepared, in all material respects, in accordance with the applicable reporting criteria. It results in a positive conclusion. from a future date in a gradual manner.

- Phase-in reliefs: In order to reduce the reporting burden, companies have been provided certain phase-in-reliefs. These are:

- For Year One (Y1) and Year Two (Y2)

- Comparative information is not required to be disclosed in Y1

- All companies, regardless of their size, may opt out of disclosing the expected financial impacts related to risks from environmental issues in Y1. Companies can provide qualitative disclosure only on these financial impacts for further two years

- Certain disclosures related to own workforce (social protection, people with disabilities, work-related illnesses and work-life balance) could be omitted in Y1

- Companies with less than 750 employees may also omit:

- The disclosure of Scope 3 greenhouse gas emissions (ESRS E1) and other disclosures on their own workforce (ESRS S1) in Y1, and

- The disclosures on biodiversity (ESRS E4), workers in the value chain (ESRS S2), affected communities (ESRS S3) and consumers (ESRS S4) in Y1 and Y2.

- For Y1, Y2 and Year Three (Y3)

- Other available frameworks could be used to develop relevant disclosures on material sustainability-related matters, in advance of sector-specific standards

- Information on value chain is not required to be estimated and could be omitted, if the information is not available. However, this relief is not applicable to data points relevant for other EU laws or based on internal information, and includes both upstream and downstream information

Action Points for Auditors

- Auditors should engage with the companies, falling within the scope of the ESRS standards and understand how the CSRD reporting requirements would impact them and the group at large. Further, they should also evaluate with the management, how the ESRSs requirements would differ from the current level of sustainability reporting by the companies

- Since ESRSs take into account double-materiality dimensions, it is possible that a particular subject matter/criteria, which may not be material under the extant financial materiality benchmark becomes material under the ESRSs. Thus, auditors should evaluate the impact of double materiality on the sustainability disclosures made by companies under the ESRS framework.

- Practitioners may conduct pre readiness assessment engagements to assess the control environment, data quality and availability of sufficient documentation with the companies in order to provide a limited assurance on the sustainability information.

Our Insights

Tools and Enablers

- Standard workpapers

- Technology tools

Resources

- Regulatory updates

-

India updates

Accounting updates

Auditing updates

Regulatory updates

-

International updates

Accounting updates

Auditing updates

Regulatory updates

-

Recap on key updates

-

Publications

India Publications

International Publications

-

Matter for auditors’ attention

-

Discussion/Consultation papers and Publications issued by regulators

India Publication

International Publication

Exposure Drafts/consultation papers

EDs/consultation papers

Matters for Consultation