Regulatory updates

Updates from RBI

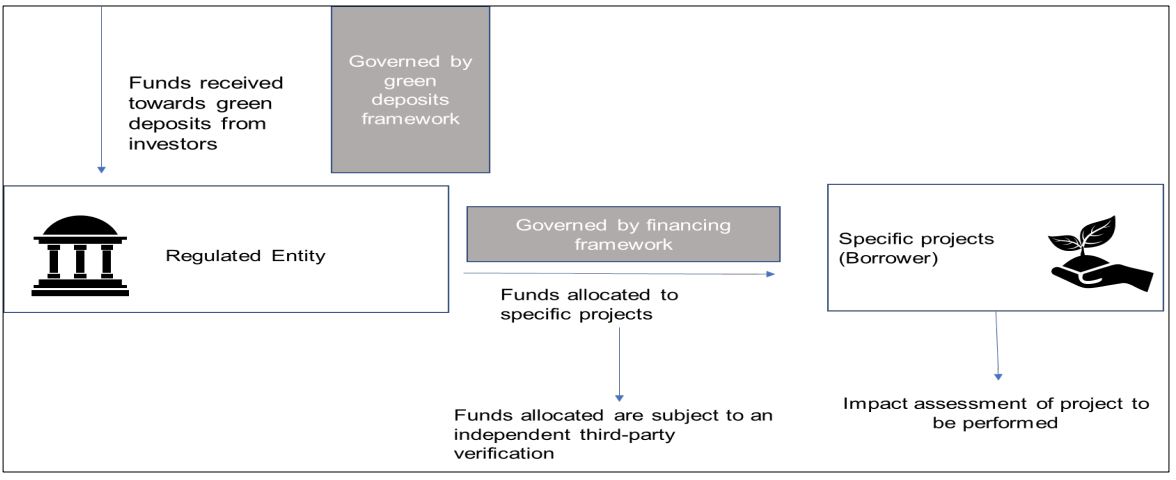

Green finance1Green finance refers to the lending to and/or investing in the activities/projects meeting the prescribed requirements, that contribute to climate risk mitigation, climate adaptation and resilience, and other climate-related or environmental objectives-including biodiversity management and nature-based solutions. has been progressively gaining traction in India and could play a pivotal role in mobilising resources and their allocation in green activities and projects. The Reserve Bank of India (RBI) observed that some Regulated Entities (REs) have already offered green deposits for financing green activities and projects. In this regard, on 11 April 2023, RBI issued a Framework for acceptance of green deposits (the Framework) for the REs. An illustration of how the system for green deposits works is given in figure 1 below:

Figure 1: An illustration of the system for green deposits

(Source: Foundation for Audit Quality’s analysis, 2023)

Some of the key aspects enunciated in the Framework include:

-

Applicability and Effective Date: The Framework would be applicable to the following Regulated Entities (REs):

- Scheduled Commercial Banks (SCBs) including Small Finance Banks (excluding Regional Rural Banks, Local Area Banks and Payments Banks), and

- All Deposit taking Non-Banking Financial Companies (NBFCs) registered with the RBI, including Housing Finance Companies (HFCs).

The framework would come into effect from 1 June 2023.

-

Frameworks/policies to be developed by REs:

REs would be required to develop and publish the following policies on their websites, after they are duly approved by the board of directors of the REs:

-

Policy on green deposits: The policy on green

deposits would lay down all aspects pertaining to the

issuance and allocation of green deposits. This includes

the following:

- Green deposits would be issued in INR as acumulative/non-cumulative deposit

- On maturity, the green deposits would be renewed or withdrawn, at the option of the depositor

- The policy would also define the tenor, size, interest rate and other terms and conditions (as applicable to the RE).

-

Financing framework: REs would be required to put in place a board approved Financing Framework (FF) for effective allocation of green deposits. The FF would cover the following:

- The eligible green activities/projects that could be financed out of proceeds raised through green deposits.

- Process for identifying, evaluating and selecting the projects fit for lending/investing within the eligible categories. Also monitoring and validating the sustainability information provided by the borrower.

- Allocation of proceeds of green deposits to the various projects and reporting of such allocation.

- Third party verification or assessment of allocation of proceeds and assessment of impact associated with funds lent for or invested in green finance activities/projects.

- Particulars of temporary allocation of green deposit proceeds2Temporary allocation of proceeds of green deposits would be only in liquid investments, which have a maximum original tenure up to one year., pending their allocation to eligible activities/projects

-

Policy on green deposits: The policy on green

deposits would lay down all aspects pertaining to the

issuance and allocation of green deposits. This includes

the following:

The FF would also undergo a review by an external agency – this review report would also be made available on the RE’s website.

- Use of proceeds: The Framework states that the REs must allocate the proceeds raised through green deposits towards the activities/projects which encourage energy efficiency in resource utilisation, reduce carbon emissions and greenhouse gases, promote climate resilience, adaptation and value, improve natural ecosystems and biodiversity. Some of the key sectors specified in this regard include:

- Renewable energy

- Energy efficiency

- Clean transportation

- Climate change adaptation

- Sustainable water and waste management

- Pollution prevention and control

- Green buildings

- Sustainable management of living natural resources and land use

- Terrestrial and aquatic biodiversity conservation.

- Third-party verification/assurance and impact assessment: The Framework has provided that the allocation of funds raised through green deposits during a Financial Year (FY) would be subject to an independent third-party verification/assurance, on an annual basis. Further, the third-party verification/assurance report should, at the minimum, cover the following aspects:

- Use of the proceeds to be in accordance with the eligible green activities/projects. The REs should monitor the end-use of funds allocated against the deposits raised, and

- Policies and internal controls, including project evaluation and selection, management of proceeds and validation of sustainability information provided by the borrower to the REs and adequate reporting and disclosures.

Also, it has been specified that the REs, with the assistance of external firms, must annually assess the impact associated with the funds lent for, or invested in green finance activities/projects through an impact assessment report3An illustrative list of impact indicators has been provided in Annex 1 of the Framework.. In this regard, the Framework states that the impact assessment exercise should be undertaken on a voluntary basis for F.Y. 2023-24. However, this would become mandatory from F.Y. 2024-25 onwards.

- Reporting and Disclosures: The Framework states that a review report should be placed by the RE before its board of directors within three months of the end of the FY, which must cover the following details:

- Amount raised under green deposits during the previous FY

- List of green activities/projects to which proceeds have been allocated, along with a brief description of the projects

- Amounts allocated to the eligible green activities/projects, and

- A copy of the third-party verification/assurance report and the impact assessment report.

Additionally, disclosures are required to be provided in the annual financial statements of the RE regarding the use of green deposit funds in the format prescribed by the Framework.

To access the text of the Framework, please click here

Action Points for Auditors

As part of the framework, external reviewers/agencies/consultants would need to be involved in the following aspects:

- Reviewing the FF developed by the RE and issuing a review report on the same

- Verify the allocation of funds raised by way of green deposits towards green initiatives or activities

- Perform an impact assessment along with the RE (on an annual basis) of the green finance activities or projects where the RE has invested or has lent funds which have been raised through green deposits.

Also, clarification is required on whether the review report to be placed by the RE before its board of directors within three months on an annual basis providing certain information would be subject to an external review by auditors or an external agency.

Our Insights

Tools and Enablers

- Standard workpapers

- Technology tools

Resources

- Regulatory updates

-

India updates

Accounting updates

Auditing updates

Regulatory updates

-

International updates

Accounting updates

Auditing updates

Regulatory updates

-

Recap on key updates

-

Publications

India Publications

International Publications

-

Matter for auditors’ attention

-

Discussion/Consultation papers and Publications issued by regulators

India Publication

International Publication

Exposure Drafts/consultation papers

EDs/consultation papers

Matters for Consultation