The Government of India has amended the foreign investment norms by making it mandatory for countries sharing land borders with India to take prior approval from the Indian Government before making any subscriptions or acquisitions within India. In this regard, MCA has notified a slew of amendments as given below:

| Rules amended |

Applicability date |

| The Companies (Prospectus and Allotment of Securities) Rules, 2014 (Prospectus Rules) |

5 May 2022 |

The Companies (Incorporation) Rules, 2014

- Revised form INC-9

- Revised form SPICe32

|

1 June 2022 |

| The Companies (Share Capital and Debenture) Rules, 2014 |

4 May 2022 |

| The Companies (Compromises, Arrangements and Amalgamations) Rules, 2016 (Amalgamation Rules) |

30 May 2022 |

The Companies (Appointment and Qualification of Directors) Rules, 2014 (Directors Rules)

• Revision of Rule 8 and form DIR-2

• Revision of Rule 10 and form DIR-3

|

1 June 2022 |

Companies (Prospectus and Allotment of Securities) Amendment Rules, 2022

Rule 14 of the Companies (Prospectus and Allotment of Securities) Rules, 2014 (Prospectus Rules) states that a prior approval of shareholders by a special resolution is required by an entity, before it makes an offer to subscribe to securities through private placement. Further, an offer or an invitation to subscribe to securities would be made through issue of private placement offer letter in form PAS-4.

MCA, vide a notification dated 5 May 2022 issued the Companies (Prospectus and Allotment of Securities) Amendment Rules, 2022, which has inter aliainserted a new proviso under Rule 14(1) (Private placement) of the Prospectus Rules. As per the amendments, no offer or invitation of any securities should be made (under Rule 14 of the Prospectus Rules) to a body corporate incorporated in, or a national of, a country which shares a land border with India, unless such body corporate or the national have obtained the Government approval under the Foreign Exchange Management (Non-debt Instruments) Rules, 2019 and have attached the same with the private placement offer cum application letter. These amendments have been made in the form PAS-4.

The Rules come into force from the date of publication in the Official Gazette (i.e. 5 May 2022).

To access the text of the MCA notification, please click here

Revised form INC-9 issued

As per Section 7 of the Companies Act, 2013 (dealing with incorporation of companies) read with Rule 15 of the Companies (Incorporation) Rules, 2014, each of the subscribers to the memorandum of association and persons named as the first directors in the articles of association need to make certain declarations in form INC-92:

MCA, vide a notification dated 20 May 2022 has issued revised form INC-9. As per the revised form INC-9, in addition to the existing declarations, subscribers to the memorandum and first directors of the companies are now required to confirm whether they need to obtain a Government approval under the Foreign Exchange Management (Non-debt Instruments) Rules, 2019 prior to the subscription of shares3.If a Government approval is required then, enclose such clearance in the form.

Additionally, in the form SPICe32 (form for incorporation of a company), when a national of a country who shares land border with India seeks appointment in a company being incorporated in India then, entities need to submit the security clearance (of such individual) obtained from the Ministry of Home Affairs.

The amendment has come into effect from 1 June 2022.

To access the text of the notification, please click here

The Companies (Share Capital and Debentures) Amendment Rules, 2022

As per Section 56 of the Companies Act, 2013 read with Rule 11 (1) of the Companies (Share Capital and Debenture) Rules, 2014, securities held in physical form need to be transferred in form no. SH-4. The following information needs to be provided in Form SH-4:

- Details of the securities to be transferred

- Details of the transferor, and

- Details of the transferee

On 4 May 2022, MCA issued the Companies (Share Capital and Debentures) Amendment Rules, 2022, thereby requiring additional declarations for the transferee in form SH-4. These additional declarations include whether the transferee requires to obtain a government approval under the Foreign Exchange Management (Non-debt Instruments) Rules, 2019 prior totransfer of shares, and enclosure of such approval (where required and obtained).

The Rules come into force from the date of publication in the Official Gazette (i.e. 4 May 2022).

To access the text of the notification, please click here

The Companies (Compromises, Arrangements and Amalgamations) Amendment Rules, 2022

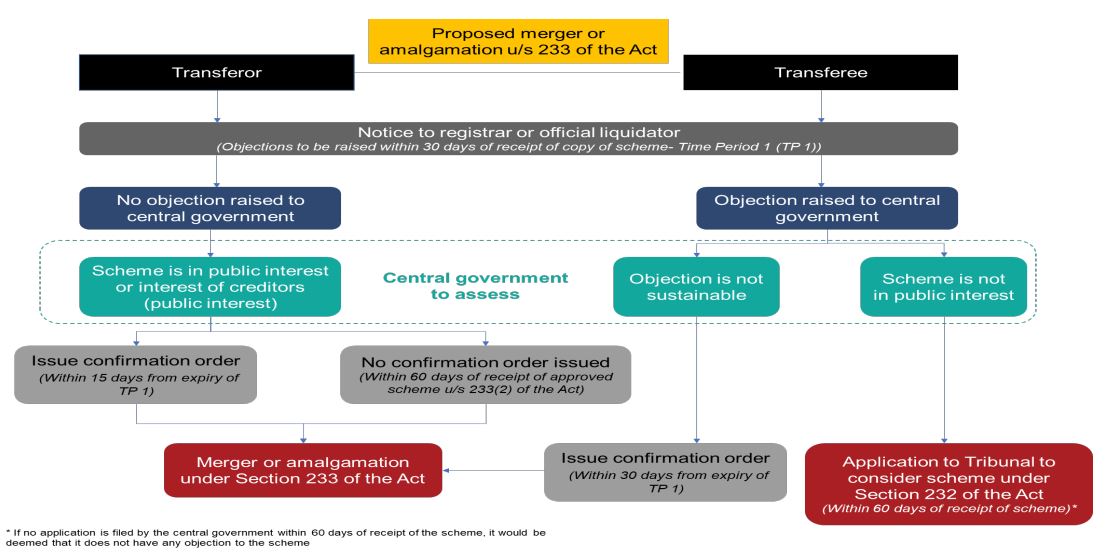

As per Rule 25A of the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016 (Amalgamation Rules) if a foreign company incorporated outside India intends to merge with an Indian company, or vice versa, it needs to file an application before the Tribunal as per provisions of Sections 230 to 232 of the Companies Act, 2013 read with the Amalgamation Rules. Additionally, certain provisions stated in the Companies Act, 2013 and the Amalgamation Rules need to be complied with.

The MCA, vide a notification dated 30 May 2022 has issued the Companies (Compromises, Arrangements and Amalgamations) Amendment Rules, 2022. As per the amendment, in case of a compromise, an arrangement, merger, or demerger between an Indian company and a company or body corporate which has been incorporated in a country which shares land border with India, a declaration in Form No. CAA-16 would be required at the stage of submission of application under section 230 of the Companies Act, 2013.

Form No CAA-16, requires the authorised representative of a company/body corporate which has been incorporated in a country which shares land border with India to declare whether the company/body corporate is required to obtain a prior approval of the Government under the Foreign Exchange Management (Non-Debt Instruments) Rules, 2019, and enclose such approval, where obtained.

The Rules come into force from the date of publication in the Official Gazette (i.e. 30 May 2022).

To access the text of the Rules, please click here

The Companies (Appointment and Qualification of Directors) Amendment Rules, 2022

On 1 June 2022, MCA issued the Companies (Appointment and Qualification of Directors) Amendment Rules, 2022. Following are the amendments:

- Amendment in Rule 8: As per Rule 8 of the Companies (Appointment and Qualification of Directors) Rules, 2014 (Directors Rules), every person who has been appointed as a director is required to furnish to the company his/her consent in writing to act as such in form DIR-2. Further, companies are required to file such a consent with the Registrar of companies in the form DIR-12 within 30 days of appointment of the director.

The amendments now state, that in case the person seeking appointment is a national of a country which shares land border with India, necessary security clearance from the Ministry of Home Affairs, Government of India should also be attached along with the consent in form DIR-2. Requisite amendments have been made in form DIR-2.

- Amendment in Rule 10: As per Rule 9 and Rule 10 of the Directors Rules, every person who intends to be appointed as a director needs to apply to the Central Government for a Director Identification Number (DIN) in the form DIR-3. On submission of DIR-3 on the portal and payment of requisite fees, an application number is generated by the system automatically.

As per the amendment, an application number would not be generated in case the person applying for DIN is a national of a country which shares land border with India, unless necessary security clearances are obtained from the Ministry of Home Affairs, Government of India along with form DIR-3. Requisite amendments have been made in the form DIR-3.

The Rules come into force from the date of publication in the Official Gazette (i.e. 1 June 2022).

-

Form INC-9 is the form in which subscribers to the memorandum and first directors as mentioned in the articles of association of a company make following declarations:

♦ He/she is not convicted of any offence in connection with the promotion, formation or management of any company,

♦ He/she has not been found guilty of any fraud or misfeasance or of any breach of duty to any company under this Act or any previous company law during the preceding five years

♦ All the document filed with the Registrar for registration of the company contain information that is correct and complete and true to the best of his/her knowledge and belief;

- This would be the case when the person seeking appointment is a national of a country which shares a land border with India.

To access the text of the Rules, please click here

Action Points for Auditors

Auditors should take note of the companies that they audit which have foreign investments, are planning mergers with companies incorporated outside India or have directors who are nationals of countries which share a land border with India.

With regard to private placement of shares or convertible debentures (fully, partly or optionally convertible debentures) by a company during the year, auditors should take note of the reporting requirements under the CARO 2020 on:

- whether the private placement is in accordance with Section 42 of the Companies Act, 2013, and

- whether the funds raised have been used for the purposes for which they were raised. If not, details of the amount involved, and nature of non-compliance need to be reported.

Section 42 of the Companies Act, 2013 inter aliaprovides that a company can make private placement only to a select group of persons (as identified by the board of directors of a company). Thus, the auditors would need to ascertain whether the company has complied with the requirements specified in Companies (Prospectus and Allotment of Securities) Amendment Rules, 2022 in determining the group of persons for private placement. In case of any non-compliance, the auditors would need to report non-compliances in accordance with the requirements of the CARO 2020.