Global capital markets demand better information about sustainability-related matters to enable investors to factor in sustainability-related risks and opportunities in their assessment of enterprise value.

The International Sustainability Standards Board (ISSB) has been created to meet this demand. The ISSB has now published its first two proposed IFRS Sustainability Disclosure Standards which— once finalised—will form a comprehensive global baseline of sustainability disclosures designed to meet the information needs of investors when assessing enterprise value.

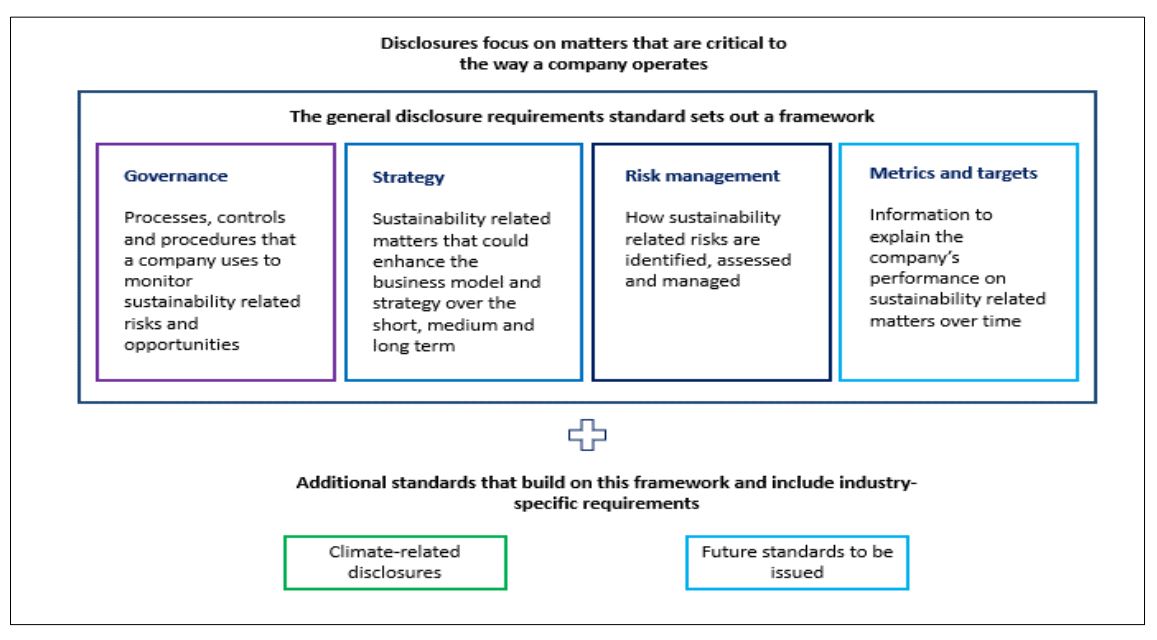

The proposed IFRS S1, General Requirements for Disclosure of Sustainability-related Financial Information (General Requirements Exposure Draft) would require companies to disclose information about all of their significant sustainability-related risks and opportunities.

The proposed IFRS S2, Climate-related Disclosures (Climate Exposure Draft) focuses on climate-related risks and opportunities. It incorporates the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and includes metrics tailored to industry classifications derived from the industry-based SASB Standards.

The ISSB seeks feedback on the proposals over a 120-day consultation period closing on 29 July 2022.

To access the text of ED on IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information, please click here

To access the text of ED on IFRS S2 Climate-related Disclosures, please click here

Action points for auditors

- With sustainability related disclosures and assurance gaining traction amongst stakeholders, the issue of exposure drafts by ISSB marks a significant step in this direction. India has demonstrated its commitment towards sustainability reporting by requiring the top 1,000 listed entities by market capitalisation to mandatorily report on Business Responsibility and Sustainability Reporting effective 1 April 2022. Considering that the exposure drafts issued will be global standards, auditors should emphasise the importance of these proposals to their clients, and encourage them to comment on the exposure draft, while it is in the drafting stage at a global level.

- The ED sets out overall requirements with the objective of disclosing sustainability-related financial information that meet the expectations of different stakeholders. Thus, the ED would provide a suitable basis to auditors for determining whether an entity has complied with the standards and would help in monitoring overall compliance.

- Since the proposals specify various disclosure requirements that might require significant changes to the entity’s overall policy framework and data capturing methodology, it may present some challenges, particularly for the auditors to verify or enforce these requirements.