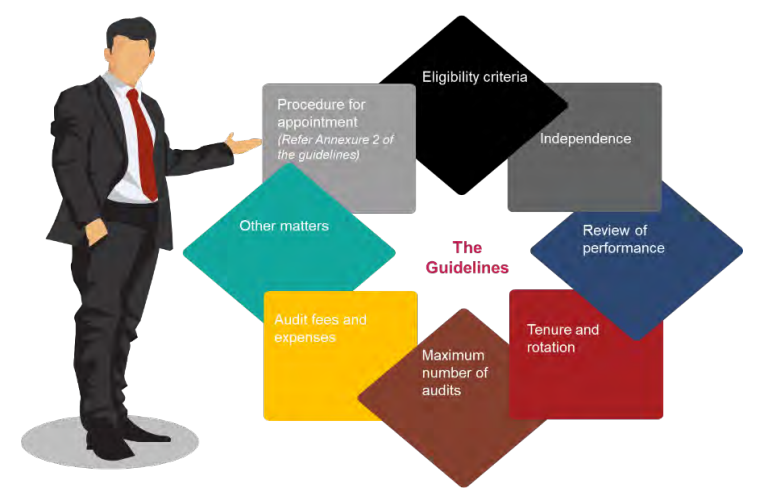

On 15 January 2024, RBI issued the guidelines on appointment/re-appointment of statutory auditors of State Co-operative Banks (StCBs) and Central Co-operative Banks (CCBs) (the guidelines). The guidelines provide guidance on the following matters pertaining to appointment/re-appointment of statutory auditors:

(Source: Foundation for Audit Quality’s analysis, 2024 read with the guidelines)

Some of the key aspects of the guidelines are discussed below:

- Applicability: The guidelines would be applicable to StCBs and CCBs w.e.f. 1 April 2024.

- Prior approval of RBI: Prior approval of RBI would be required before appointment/re-appointment/removal of statutory auditors. Further, banks would be required to seek prior approval from RBI for re-appointment of statutory auditors on an annual basis.

- Eligibility and independence of auditors: The guidelines prescribe the following with respect to the eligibility and independence of auditors:

- The audit firm, proposed to be appointed should be duly qualified for appointment as auditor of a company in terms of Section 1411 Section 141 of the Companies Act, 2013 deals with eligibility, qualifications and disqualifications of auditors of the Companies Act, 2013.

- Banks must assess the independence of auditors and conflict of interest, if any, should be appropriately raised to the National Bank for Agriculture and Rural Development (NABARD)

- Concurrent auditors of the bank should not be considered for appointment as the statutory auditors of the same bank. Further, the guidelines state that there needs to be a minimum gap of one year between the completion of one assignment and commencement of another assignment

- Additionally, it has been stated that the time gap between any non-audit work2 Services mentioned in Section 144 of the Companies Act, 2013, internal assignments, special assignments, etc. undertaken by the statutory auditor for the appointing bank should be at least one year (both before the appointment and after completion of tenure as the statutory auditor).

- However, during its tenure as the statutory auditor, an audit firm may provide such services to the appointing bank which may not normally result in conflict of interest3 Special assignments, including those such as (i) Tax audit, tax representation and advice on taxation matters, (ii) Audit of interim financial statements, (iii) Issuance of certificates that are required to be made in compliance with statutory or regulatory requirements, and (iv) Reporting on financial information or segments thereof, may not be treated as conflict of interest. .

- The above restrictions would also apply to an audit firm under the same network of firms or any other audit firm having common partner(s), as defined in Rule 6(3) of the Companies (Audit and Auditors) Rules, 2014.

- While appointing auditors, banks would also need to consider the CISA/ISA/DISA qualification of the auditor and their audit experience.

- Tenure and rotation: The guidelines specify that:

- The statutory auditors would be appointed at a time for a period of one year only and should be reappointed annually for the succeeding two years . During such period, premature removal of the statutory auditors would require prior approval of the RBI

- An auditor/audit firm would not be eligible for appointment/re-appointment in the same bank for six years (two tenures) immediately after the completion of a full or part tenure4 In case an auditor/audit firm has conducted audit of the bank for part-tenure (one or two years) and then is not re-appointed for the remainder tenure, it would not be eligible for re-appointment in the same bank for six years after the completion of part-tenure. However, audit firms can continue to undertake statutory audit of other banks. .

- Maximum number of audits: An audit firm can concurrently take up the statutory audit of a maximum of five banks5 The limit of five banks would be in addition to the limit of 20 Regulated Entities (REs), as prescribed in the Guidelines for Appointment of Statutory Central Auditors (SCAs)/Statutory Auditors (SAs) of Commercial Banks (excluding RRBs), UCBs and NBFCs (including HFCs) dated 27 April 2021. (including not more than one StCB) in a year. Further, in a year, an audit firm cannot simultaneously take up the statutory audit of both StCB and CCBs operating in the same state. An audit firm can concurrently take up the statutory audit of a maximum of four commercial banks [including not more than one Public Sector Bank (PSB) or one All India Financial Institution6 NABARD, SIDBI, NaBFID, NHB, EXIM Bank or RBI, eight Urban Co-operative Banks (UCBs), eight Non-Banking Financial Companies (NBFCs), and five StCBs/CCBs in a year.

- Review of performance of auditors: Banks must review the performance of statutory auditors on an annual basis and any serious lapse/negligence should be reported to NABARD within two months from the completion of audit.

- Other requirements: The guidelines mention that:

- Banks should frame a Board-approved policy on appointment of statutory auditor and host the same on its website/public domain

- Banks should also formulate the necessary procedures for selection/appointment/ re-appointment/removal of auditor.

- Appendices: In addition to the requirements discussed above, the guidelines also incorporate:

- Eligibility criteria for appointment as a statutory auditor (Appendix I to the guidelines)

- Procedure for appointment (Appendix II to the guidelines), and

- Guidelines for selection of branches for audit by the statutory auditors (Appendix III to the guidelines).

To access the text of the guidelines, please click here

Action points for auditors

Auditors should ensure that they meet the eligibility criteria and independence requirements stipulated in the guidelines. They should also check whether they are in compliance with the maximum number of audits permitted.